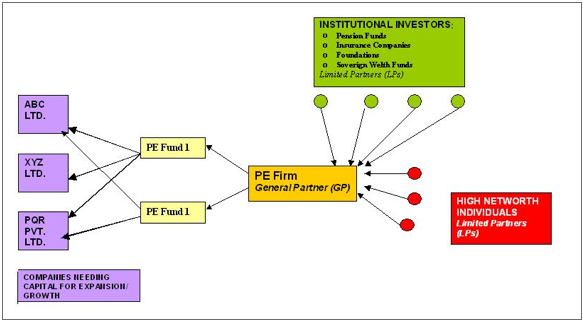

Investment Banking provides fresh insight and perspective to valuation analysis, the basis for every great trade and winning deal on Wall Street. The book is written from the perspective of practitioners, setting it apart from other texts. The best book for valuation on the market, Investment Banking makes concept easy to understand with great examples which lead the student from start to finish. I used this book in my Mergers and Acquisitions class over the text which was assigned, because it. Rosenbaum (New York, NY) is an Executive Director in UBS Investment Bank's Global Industrials Group. He received his BA from Harvard University and his MBA, with Baker Scholar honors, from the Harvard Business School. Jon has over 17 years of business valuation, merger acquisition, and capital raising experience. He is an Accredited Valuation Analyst (AVA) through the National Association of Certified Valuation Analysts (NACVA). Investment Banking Valuation Leveraged buyouts and Mergers acquisitions Second Edition 653 Pages. Investment Banking Valuation Leveraged buyouts and Mergers acquisitions Second Edition. Investment Banking: Valuation, Leveraged Buyouts, and Mergers Acquisitions is a handbook for aspiring investment bankers. It addresses three main topics: valuation, leveraged buyouts, and corporate mergers and acquisitions. The sections on valuation describe three methodologies that are based on comparable companies, precedent transactions, and discounted cash flow, respectively. PCE provides middle market business owners with awardwinning investment banking, valuation, advisory and ESOP services. From growth strategies and exit events to valuations and Employee Stock Ownership Plans, we provide a full range of services for business owners. Investment Banking: Valuation, Leveraged Buyouts, and Mergers Acquisitions is a highly accessible and authoritative book that focuses on the primary valuation methodologies currently used on Wall Streetcomparable companies, precedent transactions, DCF, and LBO analysis. The Wall Street Prep Advantage. I want to move into investment banking or a valuation role for investment banking and that was my main goal for taking the premium training program. The material is structured in logical sequence in such a way that one concept leads nicely to. Valuation is not as analytical as investment banking, but more technical. You will learn a lot about valuation methodologies, minus the LBO. Investment bankers don't place that much emphasis on the technicals, however, I feel like it useful for buyside analysis. This is a fantastic book to teach a novice what investment bankers do. It covers the basics of company valuation, LBOs and MA. I recommend this for anyone who is emerging from business school and planning a career in investment banking. Welcome to rFinance a place to discuss multiple facets of corporate and advanced finance (and careers within), including: financial theory, investment theory, valuation, financial modeling, financial practices, and news related to these topics. Valuation University is a free resource for anyone aspiring to break into Investment Banking and learn the basics of Financial Modeling Valuation University is a resource for anyone aspiring to work in Investment Banking to learn everything about Investment Banking and Financial Modeling. A valuation is the process of determining the current worth of an asset or company. If the NPV is a positive number, the company should make the investment and buy the asset. A timely update to the global bestselling book on investment banking and valuation In the constantly evolving world of finance, a solid technical foundation is an essential tool for success. Using the PE ratio as an example, if an investment banker is trying to perform a valuation of a firm in the grocery store business, the first step would be to determine the average PE ratio in. Financial Modeling DCF Valuation Model: Investment Banking 3. 2 (73 ratings) Course Ratings are calculated from individual students ratings and a variety of other signals, like age of rating and reliability, to ensure that they reflect course quality fairly and accurately. FREE Investment Banking Manual Covering accounting fundamentals, valuation, financial modeling, Excel skills, this 400 page guide to investment banking is a musthave for new analysts associates. Stouts investment banking team specializes in providing mergers and acquisitions advice, private capital raising and other financial advisory services. Valuation Advisory Stout provides expertise across a broad spectrum of industries in the valuation of business enterprises, complex securities, intellectual property, real estate, and. Investment Banking: Valuation, Leveraged Buyouts, and Mergers Acquisitions is a handbook for aspiring investment bankers. It addresses three main topics: valuation, leveraged buyouts (LBOs), and corporate mergers and acquisitions (MA). This excel provides a DCF valuation template which is a valuation method where future cash flows are discounted to present value. The valuation approach is widely used within the investment banking and private equity industry. Top Best Investment Banking Books Investment banking is a highly specialized field where financial entities known as investment banks assist public and private corporations issue equity and debt securities along with helping facilitate corporate restructuring, Mergers Acquisitions (MA) and an entire range of highly complex transactions. Naturally, there is a wealth of literature. Investment Banking: Valuation, Leveraged Buyouts, and Mergers Acquisitions is a highly accessible and authoritative book that focuses on the primary valuation methodologies currently used on Wall Streetcomparable companies, precedent transactions, DCF, and LBO analysis. These methodologies are used to determine valuation for public and. Investment Banking Strategy Valuation Advisory Services from SCH Capital provide MA, corporate finance, valuation and capital raising services to middle market companies. Investment Banking Strategy Valuation Advisory Services from SCH Capital provide MA, corporate finance, valuation and capital raising services to middle market. 1 guide to investment banking and valuation methods, including online tools. In the constantly evolving world of finance, a solid. Equity Valuation: Models from Leading Investment Banks Edited by Jan Viebig Thorsten Poddig Armin Varmaz John Wiley Sons The No. 1 guide to investment banking and valuation methods, including online tools In the constantly evolving world of finance, a solid technical foundation is an essential tool for success. Investment bankers use a range of methodologies when working on valuation models, this tutorial will help you understand what the different types of methods are and when to use them. Below we take a look at the following investment banking valuations: Comparable Company Analysis, Precedent. Free valuation guides to learn the most important concepts at your own pace. These articles will teach you business valuation best practices and how to value a company using comparable company analysis, discounted cash flow (DCF) modeling, and precedent transactions, as used. Headquartered in the financial capital of the world in New York City, The Investment Banking Institute is the financial industrys leading skills training firm. Over the last 15 years we have trained nearly 35, 000 finance professionals worldwide to thrive in a fastpaced, highly rewarding industry. Investment Banking provides a highly practical and relevant guide to the valuation analysis at the core of investment banking, private equity, and corporate finance. Investment Banking: Valuation, Leveraged Buyouts, and Mergers Acquisitions, Second Edition is a highly accessible andauthoritative book that focuses on the primary currently used on Wall precedent transactions, DCF, and LBO analysisaswell as MA analysis. These methodologies are used to. of Investment Banking Technical Training. Investment banks perform two basic, critical functions for the global marketplace. First, investment banks act as intermediaries between those entities that demand capital (e. corporations) and those that supply it (e. In this guide you will find a detailed overview of the valuation. I really didnt know which direction I would head in, so I pursued almost anything that seemed related to my work experience corporate finance, investment banking, private equity, and even joining a valuation business modeling group at a Big 4 firm. Investment Banking: Valuation, Leveraged Buyouts, and Mergers Acquisitions Edition 2 The No. 1 guide to investment banking and valuation methods, including online tools In the constantly evolving world of finance, a solid technical foundation is an essential tool for success. Mariner Capital Advisors, formerly Allied Business Group, was founded in 2002 with the mission of bringing unparalleled investment banking, valuation and forensic, and business advisory services to middle market companies. Our diverse team of professionals provides solutions to the complex challenges faced by business owners throughout the country. The investment banking industry, and many individual investment banks, have come under criticism for a variety of reasons, including perceived conflicts of interest, overly large pay packages, Investment Banking: Valuation, Leveraged Buyouts, and Mergers Acquisitions. Investment Banking Valuation Models has 44 ratings and 3 reviews. Steve said: i read the 2nd Edition of IB valuation, LB, MA. Wish Investment Banking provides a highly practical and relevant guide to the valuation analysis at the core of investment banking, private equity, and corporate finance. Mastery of these essential skills is fundamental for any role in transactionrelated finance. I am looking to increase my understanding of Investment Banking to potentially increase my marketability for positions. I have chosen to purchase Investment Banking: Valuation, Leveraged Buyouts, and Mergers Acquisitions (Wiley Finance) the 2nd edition by Rosenbaum. A timely update to the global bestselling book on investment banking and valuation In the constantly evolving world of finance, a solid technical foundation is an essential tool for success. Investment Banking: The Dream Begins is for people who want to understand value. This book can help you get your arms around the many tasks and variables involved in effective valuation of a company and help you decide what kind of help you should enlist to complete a deal. Investment Banking, Second Edition Valuation ModelsDownload includes worldclass valuation andtransaction models to complement the global bestselling guide ininvestment banking Five valuation model templates along with completed versions areaccessible for purchase and use downloadable in electronic formaton the book's website. Investment Banking: Valuation, Leveraged Buyouts, and Mergers Acquisitions is a highly accessible and authoritative book that focuses on the primary valuation methodologies currently used on Wall Streetcomparable companies, precedent transactions, DCF, and LBO analysis. Investment Banking WORKBOOK is the idealcomplement to Investment Banking, Valuation, Leveraged Buyouts, and Mergers Acquisitions, Second Edition, enablingyou to truly master and refine the core skills at the center of theworld of finance. So what does an investment bank actually do? Below we break down each of the major functions of the investment bank, and provide a brief review of the changes that have shaped the investment banking industry through the aftermath of the 2008 financial crisis..